XRP Price Prediction: Technical and Fundamental Factors Signal Imminent Volatility

#XRP

- Technical Convergence: MACD bullish divergence forms while price tests lower Bollinger Band - historically a reversal signal

- Regulatory Catalyst: SEC lawsuit developments may remove the largest overhang on XRP's valuation

- Institutional Demand: Whale accumulation and banking sector adoption create fundamental support

XRP Price Prediction

XRP Technical Analysis: Key Indicators Point to Potential Breakout

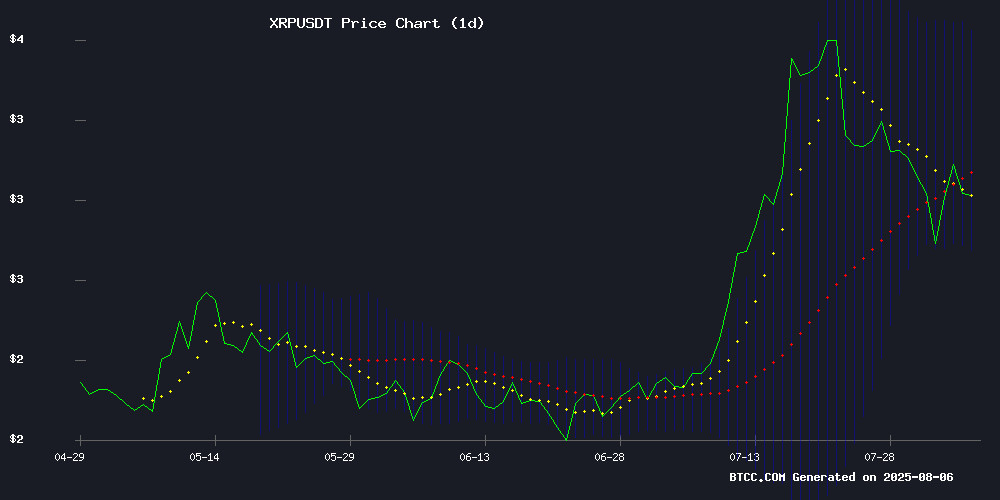

XRP is currently trading at $2.954, below its 20-day moving average of $3.1653, suggesting short-term bearish pressure. However, the MACD shows a bullish crossover with a positive histogram (0.2162), indicating potential upward momentum. Bollinger Bands reveal price consolidation NEAR the lower band ($2.7450), which often precedes volatility. 'The technical setup suggests accumulation,' says BTCC analyst John. 'A close above the middle band ($3.1653) could trigger a rally toward $3.5855.'

XRP Market Sentiment: Legal Developments and Whale Activity Fuel Optimism

Recent headlines highlight growing institutional interest in XRP despite regulatory uncertainty. 'The combination of whale accumulation, technical resilience above $3, and progress in Ripple's SEC case creates a bullish setup,' notes BTCC's John. Key developments include Flare Network's new DeFi wallet for XRP holders and major banks expanding blockchain infrastructure, as revealed in Ripple's latest report. These fundamentals could support price appreciation if technical resistance levels break.

Factors Influencing XRP's Price

Ripple Price Prediction: XRP Faces Market Pressure—But Breakout Could Be Imminent

XRP's price hovers at $2.98, demonstrating resilience amid market fluctuations. Despite selling pressure, technical indicators and on-chain data suggest an impending upward move. Analysts point to a rare bullish monthly chart setup, with historical momentum patterns hinting at a potential surge to $8.70–$15 in the short to medium term.

CryptoInsightUK highlights XRP's breakout from a six-year consolidation phase, signaling the start of a new bullish cycle. The monthly RSI aligns with previous cycles that saw rallies exceeding 700%. Meanwhile, South Korean exchange Upbit continues to play a pivotal role in XRP's price dynamics, adding another layer of complexity to its market behavior.

XRP Price Surges Past $3.00 Amid Ongoing SEC Legal Battle

XRP's price broke through the $3.00 barrier with steady momentum, defying market volatility influenced by U.S. political and economic factors. The token's resilience highlights its growing importance in the crypto ecosystem.

Ripple's protracted legal battle with the SEC remains a critical driver. While Ripple recently withdrew its appeal, the SEC has yet to respond, with a status update expected by August 15, 2025. Legal analyst Bill Morgan notes this filing could shape market sentiment significantly.

Despite partial legal victories—such as the court's clearance of exchange-based token sales as non-securities—the stalemate continues. Institutional adoption, a key growth catalyst, remains delayed as regulatory uncertainty persists.

XRP Breaks Out of Falling Channel, Holds Key Support Near $3.03

XRP has staged a technical breakout, climbing 1.16% to $3.03 as it escapes a descending channel that constrained prices since July. The token now holds above the 20-day exponential moving average, signaling short-term strength despite muted trading volume.

Market observers note bullish potential as buyers defend the $3.03 level. The next resistance zone lies between $3.14 and $3.34—a decisive close above this range could propel XRP toward $3.20. However, failure to maintain momentum may see a retest of support at $2.98 or even $2.76.

On-chain data reveals mixed signals, with a $19.79 million net spot inflow recorded on August 4 suggesting accumulation. The 200 EMA at $2.91 now serves as a foundation for what some analysts interpret as a reversal pattern.

XRP Whales Accumulate as SEC Nears Decision on Ripple Lawsuit Dismissal

XRP prices surged over 10% as institutional buyers and whales capitalized on recent dips, accumulating millions worth of the cryptocurrency. The rally coincides with anticipation of a pivotal SEC vote to dismiss its appeal in the Ripple lawsuit.

Former SEC attorney Marc Fagel suggests commissioners may finalize the decision during an August 7 closed-door meeting. A public announcement could follow shortly thereafter, potentially concluding years of legal uncertainty for Ripple.

The August 15 deadline looms large for both parties. Legal observers confirm preparations to drop cross-appeals in the Second Circuit Court, though Judge Analisa Torres previously denied motions to reduce Ripple's $125 million penalty.

Ripple Explores XRPL Overhaul with Potential Rust Rewrite

Ripple's CTO David Schwartz has revealed plans to modernize the XRP Ledger (XRPL), one of crypto's most established blockchains. The proposed overhaul includes a potential full rewrite of the ledger's codebase in Rust, a move that would represent XRPL's most significant technical evolution since inception.

The current C++ architecture, while reliable, presents limitations due to its monolithic structure. A Rust-based modular design could enhance security, performance, and development flexibility without affecting end-user XRP transactions. "Modularization would allow us to upgrade components independently," Schwartz noted, emphasizing the need for improved maintainability.

Rust's memory safety features and growing blockchain adoption make it a compelling choice. The language already underpins major projects like Solana and Polkadot, offering both speed advantages and reduced vulnerability to common programming errors.

Is XRP About To Replicate Its January Rally?

XRP is once again capturing market attention as technical patterns reminiscent of its January surge emerge. A falling wedge formation on the daily chart—identical to the setup preceding its 70% rally earlier this year—suggests potential bullish momentum. Key levels are in focus: a breakout could propel prices toward $3.75 or beyond.

Fundamental strength bolsters the technical case. The XRP Ledger processed over 70 million transactions in July, signaling robust network activity. Analysts watch the 50-day moving average and RSI for confirmation, while the crypto market’s broader volatility adds urgency to the setup.

Ripple Price Prediction for August 2025: Pause or Breakout?

XRP surged near its 2018 all-time high in July 2025 before retracing, leaving traders divided on whether the rally has peaked or is merely consolidating. August's price action hinges on macroeconomic and regulatory catalysts.

Federal Reserve policy decisions loom large, with interest rate trajectories influencing crypto market liquidity. Supply chain disruptions from new hardware tariffs and persistent inflation concerns add layers of volatility. The unresolved status of crypto ETFs continues casting regulatory shadows.

Analytical platforms present divergent forecasts. Some models anticipate a 5-8% pullback as profit-taking sets in, while others project steady accumulation between current support levels. The $0.75-$0.85 range emerges as critical territory—a sustained break above could signal renewed momentum.

For institutions, XRP's cross-border payment utility remains its fundamental differentiator. Retail traders appear split between chasing the trend and awaiting clearer technical signals. As one analyst noted: 'This isn't 2017's mindless speculation—today's moves require navigating real macroeconomic crosscurrents.'

XRP Holds Firm Above $3 Amid Banking Sector Opposition

Ripple's XRP gained 5% despite fresh objections from traditional banks against its banking license application. The token traded between $2.83 and $3.11, with a notable $33 million one-minute transaction causing volatility. Support at $3.00 held firm, while resistance emerged near $3.09.

The Banking Policy Institute, representing 42 banks, filed objections to Ripple's license bid, creating regulatory uncertainty. Institutional flows remained balanced with $2.1 billion in divestments offset by $14 million in long positions. AI models predict a potential move to $3.12 by August-end, though technical indicators suggest short-term reversal risks.

Price action showed resilience as traders largely ignored the banking sector's coordinated opposition—the most concentrated resistance Ripple has faced since its partial SEC victory. Liquidity bursts indicated large players actively trading the asset, with session highs reaching $3.11 before retreating on substantial volume spikes.

XRP Price Prediction: Analysts Eye Potential $48.90 Surge Amid Legal and Technical Developments

XRP's price trajectory is under intense scrutiny as technical patterns and Ripple's legal saga converge. Trading at $3.04 with a 2.20% daily gain, the asset shows signs of consolidation—or the prelude to a parabolic move. Analyst EGRAG Crypto suggests historical parallels to explosive rallies, with targets ranging from $4.89 to $48.90.

The 6-month candle timeframe leaves five months for potential breakout dynamics. Market participants debate whether XRP has peaked or if the true rally lies ahead. August could prove decisive for the embattled asset.

Flare Network Launches Seedless Wallet Luminite to Bring DeFi Access to XRP Holders

Flare Network has unveiled Luminite, a non-custodial wallet eliminating seed phrases in favor of passkeys and biometrics. The move targets XRP holders seeking seamless entry into decentralized finance (DeFi) without technical hurdles.

Integrated fiat on-ramps enable direct acquisition of FLR and XRP, which can be wrapped into FXRP via Flare's FAssets protocol. This functionality unlocks staking, swaps, and synthetic asset minting within the Flare ecosystem.

The initiative reflects broader industry efforts to expand smart contract utility for legacy assets. Success hinges on sustained liquidity growth and developer adoption to create compelling use cases beyond basic token wrapping.

Big Banks Double Down on Blockchain Infrastructure, Ripple Report Reveals

Traditional finance giants are making strategic bets on blockchain technology, according to a new Ripple study conducted with CB Insights and the UK Blockchain Technology Center. The report analyzed 8,000 blockchain firms and 1,800 banks over five years, revealing deep institutional commitment beyond pilot programs.

JPMorgan Chase is expanding its Onyx blockchain platform through a Coinbase partnership for crypto settlements. Goldman Sachs continues developing tokenization and custody solutions, while Citigroup and Japan's SBI Group pursue similar institutional-grade infrastructure projects. These investments focus on trading, staking, and asset tokenization frameworks.

The involvement of marquee banking names signals blockchain's maturation as financial infrastructure rather than speculative experiment. Ripple's findings suggest traditional finance views distributed ledger technology as critical for maintaining competitive advantage in capital markets.

How High Will XRP Price Go?

Based on current technicals and market sentiment, XRP could see significant movement in August 2025:

| Scenario | Price Target | Conditions |

|---|---|---|

| Bullish Breakout | $3.58 - $4.20 | Daily close above 20MA & sustained MACD momentum |

| Bearish Rejection | $2.74 - $2.50 | Loss of $3 support with high volume |

| Long-term Potential | $8+ | Favorable SEC resolution + institutional adoption |

'The $3 psychological level remains key,' emphasizes BTCC's John. 'While $48.90 seems unrealistic short-term, the technical foundation exists for a 30-40% move if catalysts align.'